Kathmandu, June 30. Nabil Bank, the first private sector bank of the country, has launched Nabil Sustainable Banking Unit through a virtual program today. Through Nabil Sustainable Banking (NSB), the Bank aims at extending financial access to the unbanked while promoting entrepreneurship in the most remote corners of the country. Aligned with the UN Sustainable Development Goals, NSB seeks to intervene across geographic, demographic and economic strata to facilitate the creation of sustainable micro-enterprises for a better Nepal.

Mr. Upendra Prasad Poudyal, Chairman of the Bank stated, ‘The overall Banking sector has been able to touch millions of lives and make a difference in all respect. Over the years, we have grown and so has the size of the economy, lives of individuals and businesses. We need to remain mindful of the impacts we’ve made in the lives of the people, environment, community, national economy and the country as a whole.

Therefore, Nabil Bank has established a Sustainable Banking Department, a focused banking approach to support the real economy at grassroots level. We are not only focused on profit maximization but on maximizing integrated value which combine financial, social and economic value. With this, we will consider the impact on companies we invest on, the society and the overall ecosystem.’

Mr. Anil Keshary Shah, CEO of the Bank introduced Sustainable Banking as a new discipline in the banking sector, which is gaining increasing importance every day due to its impact in the plant and people. Nabil Bank, a pioneer bank in the industry, has brought the concept of Sustainability into its strategic direction. The bank has already been working toward Green Banking, Carbon Accounting in its lending portfolios, and lending to create Sustainable impact in rural and backward people.

The Bank has launched two products namely Nabil Kisan Karza and Nabil Udhyamsil Karza targeting entrepreneurship development and commercialization of agriculture for the people of rural area and in the people segment having low Access to Finance. Though these products have been rolled out through all the branches across the nation, the bank shall focus on 17 selected rural branches to concentrate its Sustainable activities for creating sustainable impact on backward population.

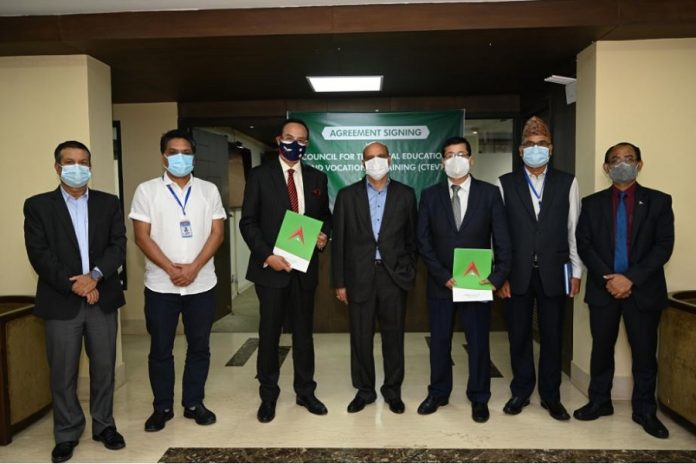

Working toward its Sustainable priorities, the Bank has also signed an MOU with Council for Technical Education and Vocational Training (CTEVT) for bridging the gap of Access to Finance to the trained graduate of CTEVT. Through this MOU, the bank shall provide its sustainable and other microfinance/deprived sector products to student/graduates of CTEVT and its affiliates across the nation. This will help promote entrepreneurship development in these trained resources. The MOU was signed by CEO of the Bank, Mr. Anil Keshary Shah and Member Secretary of CTEVT Mr. Jeeb Narayan Kafle.

Member Secretary of CTEVT has stated that the MOU between CTEVT and Nabil is a milestone way forward to the entrepreneur development and Sustainable Development goal of the nation.