It seems to be a latest trend that most of the investors nowadays are awed by the market Index. Their investing decisions are based heavily on the index. Watching the index has been their favorite pastime. They track the index every now and then, as if they have invested in the index, and not stocks. It is surprising that many of the Index maniacs chanting slogans like “Boom boom NEPSE” fail to earn, even when the market increases. It’s because the increase in index means nothing unless our stocks performs. It is similar to looking at the overall pass percentage in the exams to guessone’s passing status. A high pass percentage means nothing if we fail.

Recently, the freefall of NEPSE Index by over 25% to 2260 levels followed by the V-shaped recovery up to 2980 levels has no solid reasons what so ever.It seems that a very healthy breakout move has been triggered by improvement in overall economy. However, It’s not the case. There have been no changes in the economic fundamentals like 4/12 cap, liquidity status, deficit in balance of payments etc. that affect the market. However, the index has been wandering like a madman. And so do the investors. A slight increase in Index turns on an investor to randomly bet all his savings. A small pullback or corrections cares the hell out of them for panic sales. This paradigm shifts in the behavioral biases of the newbie traders have resulted in the excessive volatility of the index.

There has been swings in the index of high-momentum sectors like hydro, finance, development banks etc. This is due to the devious tendency of some big players to mislead the rookies by cornering such stocks with low supply. This tendency, popularly referred as “toprilidine” in native terms, has put a question mark on the reliability of stock prices as well as those sectoral sub index. Even if those tendencies are reduced, what about the accuracy of the index formulated by NEPSE. Well, they are erroneous and inefficient So, the traders that follow the index blindly are moving in the double edged word. It’s because on one hand, the index means nothing unless our portfolio performs and on the other, these index are inefficient and irrational.

Errors in the calculation of NEPSE Index:

An index is a measure of market movement that represents the general sentiment of market. It is created by selecting a few stocks that share comparable features like total market capitalization or business size or industry structure. NEPSE index considers the market capitalization of all the companies listed in the Exchange. The NEPSE index is calculated by dividing the total market capitalization by base market capitalization which is then multiplied by hundred. It is the sheer brilliance of NEPSE that both the variables are wrongly calculated. Firstly, the base capitalization is not fairly adjusted in regards to new listings that increases the capitalization. Secondly, the promoter shares are considered at the market price which is prima faciefaulty.

For instance, if we take NABIL, it has 60% promoter shares and the rest 40% is public shares. The market prices of promoter share and public shares are 681 and 1117 respectively. Now it’s a no brainer that while calculating total market capitalization, both the shares are considered at their respective prices. But NEPSE calculates the promoter share at market price of publicly traded shares, which is wrong. The whole market capitalization is way too higher than it should have been. This has inflated the NEPSE index. So, the NEPSE index we see today at 2780 levels is not only misleading but also absolutely useless.

Inefficiency of NEPSE Index:

Out of total market cap of all the companies, the major chunk i.e.; about seventy percent is promoter share and is traded rarely. If we take NTC for instance, government owns 91.49% and the rest 8.51 % is only tradeable. But, In Calculating the NEPSE Index, 100 % market Cap is taken. So, how can the NEPSE index exactly reflect the market price movements when major portion of the market cap is in fact infrequently traded ?

A few high market cap stocks like NTC, NABIL, NRIC, NLIC CIT etc. have the potential to impact the overall index compared to all other stocks combined. For Instance, Let’s consider a ten percent increase in a single stock i.e.; NTC keeping all other stock prices constant. Surprisingly, It increases the whole NEPSE Index by whooping 15 points. This just signifies the impact of high market cap stock in the overall index. So, does this represent the overall market movements fairly?

Irrationality in designing the Float Index –

To overcome the abovementioned inefficiency, NEPSE Came out with the concept of Float Index that considers only tradeable portion of all the listed companies. The idea was seemingly logical as the index could now reflect the changes in market cap of publicly traded shares. However, NEPSE didn’t bother to justify the rationale behind the indexes this time around too. The float index was formulated at 2065 B.S. when the market was high which resulted the index being relatively much lower that what it ought to be. The float index is currently 190.93, which means that the market has developed only 1.9 times. This is prima-facie misrepresentation. Had the base year been 2050 B.S, the float index today would have been somewhere near 2780 levels, which would have been the correct representation. It is imperative that the base market capitalization should have been float capital at the relevant base year i.e.; 2050 B.S.

Illogical Sensitive and float Sensitive index

On 2063 B.S, NEPSE came out with an idea of Sensitive Index. It seemed that NEPSE was designing an index as per the international benchmark. If we look at the major index worldwide like BSE Sensex, NIFTY, DJIA etc. that consist of certain number of stocks like 30 or 50 or maybe 500 stocks based on their market cap. So, the investors are clear about the index and what they reflect about the markets. Some criteria were developed by NEPSE for selection of companies for the Sensitive index. A total of eighty-nine companies fulfilling the required criteria were considered in selection of Category A companies. However, the base year was taken as 2063 B.S which ought to have been 2050 B.S. Again the same old story. Had NEPSE been a bit sensitive in designing the Sensitive Index, the correct Index would have been different.

NEPSE also designed a new Index combining the characters of both the Float and Sensitive Index. The float sensitive index represents the publicly traded shares of the Category A companies selected by NEPSE. This Index seems to be more precise in representing the changes in market capitalization of Categorically selected companies by NEPSE. The base capitalization problem has misrepresented all Indexes except the NEPSE Index, as a layman would consider these indexes to represent the market growth from Inception. As a matter of fact, they don’t.

The reckless breakdown of Sub- Indices

The sub-indexes have different story altogether. On 2075 B.S, NEPSE committed yet another blunder by breaking down the sub-indexes irrationally. The insurance sub-index was broken down into life Insurance and Non-Life Insurance. Both the new sub-indices were kept same as the sub index of Insurance sector before break down. This practically implies that both the life and non-life insurance have the same market capitalization. But Is that the case? No. Then, how could this be justified? God knows. Similar fate was of the Development Bank Index breakdown into Microfinance Sector. For instance, the life insurance and non-life insurance stands out 16,108 and 12,857 levels. It simply shows that these sectors have performed amazingly compared to other sub- index which are below 7000 levels. But it is not true. The insurance and non-life insurance index are high because there has been error in calculating the index as mentioned above.

In a nutshell, we can clearly see that the index is misleading. It is unreliable. There has been error in formulation of Index and the erred index can’t represent the actual market sentiments fairly. It’s waking up call for NEPSE to revise the Index correctly. The market is considered to be the reflection of the overall economy but the faulty index isn’t. So, it’s important that NEPSE revises the index so that the indexes don’t lose their reliability.

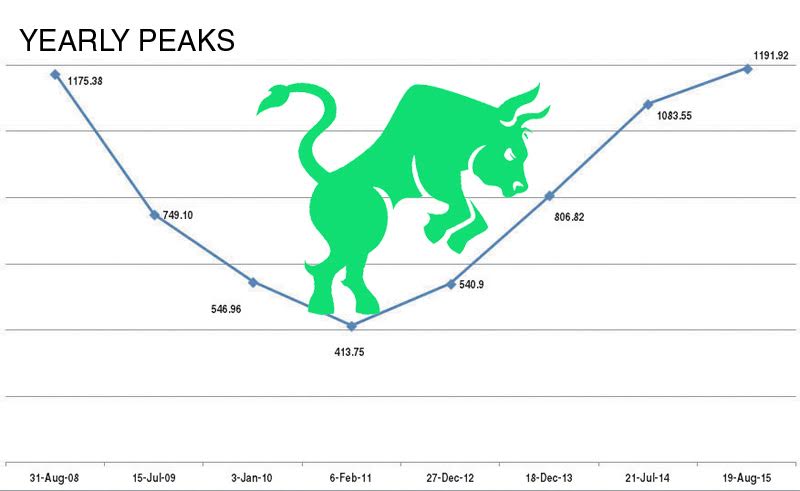

For New Investors, cleanse yourself off the Index fever and start searching for wonderful businesses at fair prices. It is always worthy to analyze the businesses in the portfolio rather than scrolling for the erred index. Every bull run is booster dose for a rookie’s confidence. There is no such thing as error in a bull run in index trading as long as the exit is made at a slightly higher price, compared to the entry one. This falsely elevates an amateur’s confidence in the index. But, in a long run, an amateur is sure to be doomed by the market as these Indexes don’t reflect actual market movements.