Writer: Brett Arends

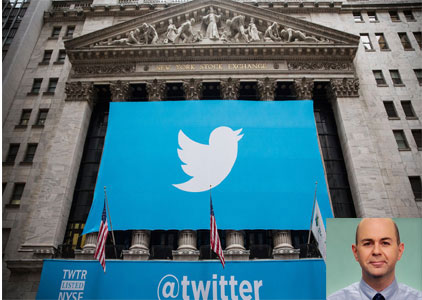

Surprised by the turmoil at Twitter? Don’t be. This is why experienced investors approach the latest hot, can’t lose, get-it-while-you-can growth stocks with rubber gloves and tongs.

Anyone who bought into Twitter’s TWTR, -0.03% IPO in 2013 and kept hold of their shares has now fared worse than they would have done in boring old stalwarts including Jack In The Box JACK, -0.30% , underwear company Hanesbrands HBI, -0.25% , Alaska Air Group ALK, +1.74% , Domino’s Pizza DPZ, -0.13% , Office Depot ODP, -0.43% , Goodyear Tire & Rubber GT, +0.06% , and even Barnes & Noble BKS, +0.15% — which I thought was a dead man walking.

All these stocks, along with hundreds of others, have outperformed Twitter since the social networking site went public in November 2013.

The stock, $26 in the IPO, was $36 last night when CEO Dick Costolo resigned. That’s a gain of 38%. Over the same period Barnes & Noble investors have made 76%, and even Macy’s M, +0.55% investors are up 53%. Jack in the Box and Hanesbrands have doubled your money.

None of this means that “growth” stocks always fail or are always a bad idea, but it is yet another reminder that in fast-growing businesses many things can go wrong — and I don’t merely mean that your disastrous first quarter earnings results will be accidentally released by a third party early, using, embarrassingly enough, Twitter’s own service.

It means that growth companies are subject to a thousand and one uncertainties that can get in the way of a good story or a good idea. And don’t expect the Wall Street scribblers to be on top of the situation. Nine months ago, when Twitter stock was peaking north of $50, more than half the analysts on the Street covering it rated it a “buy.” Oops.

Despite all the talk at the moment, the central questions investors have to ask themselves is how much they think this company’s worth — and, not coincidentally, what it’s good for.

Co-founder and interim CEO Jack Dorsey was asked on Thursday’s conference call for his “elevator pitch” about the platform’s purpose, and after waxing geekily about its “amazing capabilities” he managed to say that it could “show the world live” and let you engage in “a live conversation” with other people.

Source:Marketwatch